DEBITUM - An Easy and Reliable Global Network

DEBITUM

WHAT IS A DEBITUM NETWORK?

The Debitum Network is a network designed to simplify loans with people who lend to them, or also to investors (lenders), risk assessors, document validators, insurance companies, etc.

Companies or individual professionals working in alternative financing rooms can connect to the network for free and start facilitating cross-border transactions.

HOW TO WORK DEBITUM NETWORK?

Debitum contributes to the network and you will get DEB

Debit Network token - a solution to small business cost issues

- Sutrisno manages a handicraft company in his town and wants to export his products to Europe.

"Currently Sutrisno does not have enough capital to expand his business to international tarap, he sells all his products at affordable prices, a problem seen in business development in Europe and logistics"

- Sutrisno found a solution through the Debitum Network and he intends to borrow US $ 25,000 at 12% interest, the product in his warehouse as collateral.

- Many US and European investors decided to help finance Sutrisno and give him a loan of $ 25,000

Sutrisno likes to see his business grow, because he has more orders. Since Sutrisno successfully started his activities in Europe, investors lend. Your profits grow with Network Debitum.

we use your savings to fully provide our solutions in many markets.

Market challenges and opportunities

Global credit cracks

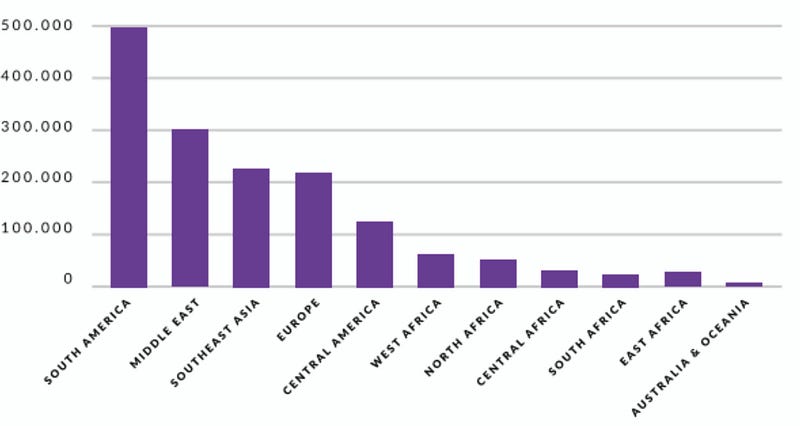

In line with World Bank reviews, approximately 70% of all micro, small and medium enterprises in emerging markets have no access to credit. At the same time, the small and medium business stratum is the most promising target audience for the financiers.

SMEs growth globally is capped by inflexible local financing, creating $ 2 trillion credit gap worldwide as accounted by IFC, the World Bank

Account data only for formal SMEs; However, the World Bank estimates that informal companies around the world have an additional credit gap of about $ 1 trillion. In addition, we must understand that the potential offers of new financial instruments also exist in developed countries that do not formally get a credit slit.

The three main pillars of the DEBITUM DEBITS Ecosystem

The Debitum Network is based on three important pillars that ensure its uniqueness, disruption and will ensure positive results on smalling credit loopholes.

- True decentralization

- HYBRID connects crypto and fiat

- Trust Base

- True decentralization - There are 154 countries represented by the World Bank where the experience of SMEs has a credit slit and where solu- tions such as the Debitum Network can help close the gapby providing partner ecosystems and linking them to global investors. However, by saying that the new Debitum Network team will be established in 154 countries and bringing ecosystems into their own markets will be a mistake.

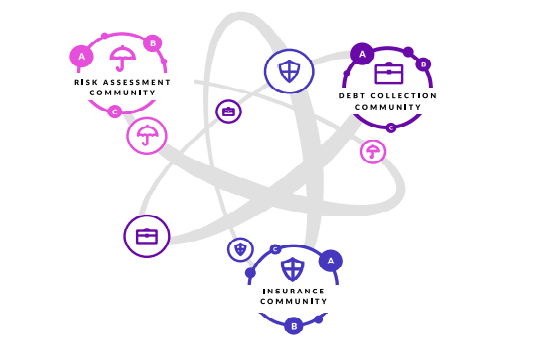

Debitum Network is the inital market maker and facilitator to solve worldwide credit gap by connecting SMEs with global investors who can rely on services provided by local or regional counterparts, ie verifcaton, risk assessment, insurance, debt collecting It is possible to reduce global investors to distribute their available capital. Communist is decentralized and truly global, comprising various service providers and 'insttutonal borrowers' - alternative phenomenal companies serving SMEs that can reduce global investment and restructure their portfolios using the Debitum Network.

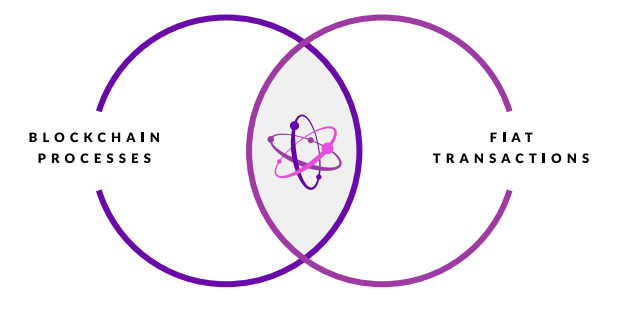

2. HYBRID connects crypto and fiat - The ecosystem has a designated facilitator to take care of all fiat transactions, it is worth noting on blockchain using smart contracts and ensuring that the ecosystem can be used from day one

The hybrid approach allows us to combine the current state of business practice with the infrastructure blockchain of the operatonal ecosystem from day one. The Debitum Network will be able to develop and transfer capital related to the loan on the blockchain. Meanwhile, Debitum will work hard to promote blockchain solutions to SMEs around the world.

3. Base of Trust - By combining reliable and efficient fiat operations, Debitum Network's blockchain-based financing process will ensure high interest from SMEs and investors. Because borrowing is primarily driven by trust in borrowers, the Debitum Network will ensure that all transactions will relate to the confidence of smart contract arbitration that will give trust to each of the single counterparty as well as the counterparty commune.

To ensure trust Debitum network confidence arbitration smart contract (smart contract) will be a blockchain-based facts such as smart service contracts involved. Any positve experience (such as a successful Implementing smart service contract) will add some trust rating points.

FOR ANY INFORMATION:

My Bitcointalk: Jambrong66

My profil bitcointalk: https://bitcointalk.org/index.php?action=profile;u=958957

Komentar

Posting Komentar